Title Insurance

Protecting Your Property Ownership Rights

Title Insurance by Western Illinois Title Company

Why You Must Have Title Insurance

Think of all the purchases you’ll ever make in your life. For the vast majority of Americans, buying a home tops them all. It’s a huge investment and the responsibilities and risk involved are equally big. It’s also one of the most complicated transactions in which you will ever engage. There’s a myriad of unfortunate variables that often become evident after a purchase which can put into question whether or not it can legally be considered a legitimate transaction. When serious title issues arise, they can threaten your rights as a property owner.

A Different Type of Insurance

Title Insurance works differently than virtually any other type of insurance. Typically, an insurance policy is written to assume risk for specified losses that may occur in the future. For instance, an automobile policy insures you against the losses incurred in the event that an automobile accident would take place. Title insurance is designed to eradicate risks and prevent losses that occur as a result of defects in a title due to past events. This is why the title search and exam process is very important. This is where the pros at Western Illinois Title Company really stand out.

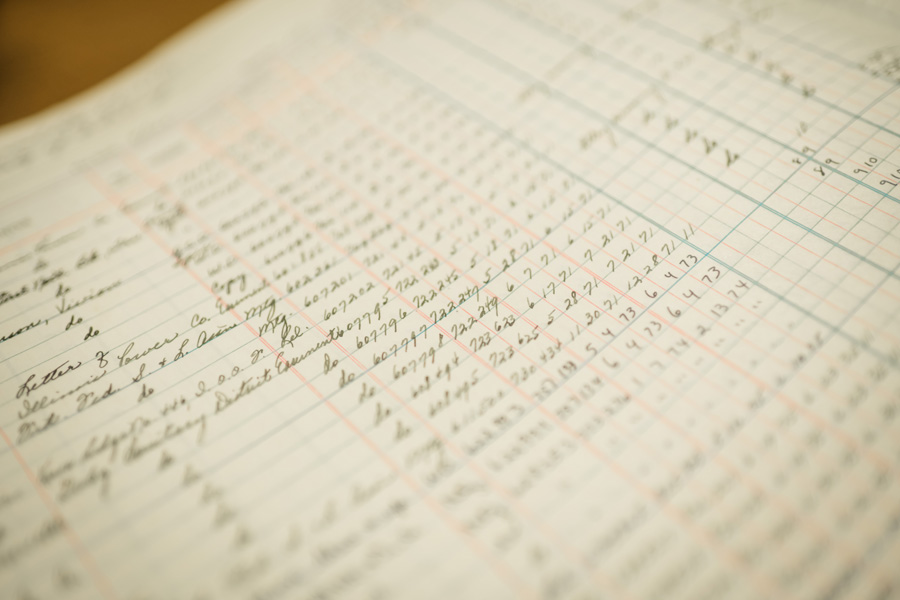

Our skilled professionals conduct comprehensive examinations of a variety of public records in order to uncover and address title risk. This includes combing through documents such as liens, tax papers, judgments, utility assessments and so much more. They evaluate real property characteristics like zoning, surveys, location, improvement types and other characteristics. If there are unreleased mortgages, liens, tax judgments or pending litigation that could result in title reassignment, they’ll find it.

Fixing the Problems

History shows that more than 30% of title searches reveal title issues that can adversely affect the ownership rights of a buyer. The professionals at Western Illinois Title Company can often eliminate these problems or provide the title insurance that will insure the risk. Our team works to protect your interest.

Completing Your Transaction

Once the title search has been completed and any necessary work has been done, one of our experienced Closers will walk you through the closing process and issue a policy of title insurance. Your title insurance policy also provides specific protection against risk that simply can’t be found from public records. These might include any type of fraud or forgery. Most can also include lack of capacity which is when an individual cannot legally agree to a contract due to a permanent condition that affects their ability to make a decision.